Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant [X] |

| ☐ | Filed by a Party other than the Registrant [ ] | |

| CHECK THE APPROPRIATE BOX: |

|

Check the appropriate box: |

|

[ ]☐ | | Preliminary Proxy Statement |

[ ]☐ | | Confidential, forFor Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X]☑ | | Definitive Proxy Statement |

[ ]☐ | | Definitive Additional Materials |

[ ]☐ | | Soliciting Material Pursuant to §240.14a-12Under Rule 14a-12 |

Aflac Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | AFLAC INCORPORATED | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box)PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

[X]☑ | | No fee required. |

[ ]☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| ☐ | | | | |

[ ] | | Fee paid previously with preliminary materials.materials: |

| ☐ | | |

[ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing. |

| | | | |

| | 1) | | Amount Previously Paid: |

| | | | previously paid: |

| | | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | 4) Date Filed: |

Table of Contents

Notice of

2017 Annual Meeting

of Shareholders and

Proxy Statement

Monday, May 1, 2017 10:00 am | Columbus Museum (the Patrick Theatre)

1251 Wynnton Road, Columbus, Georgia

Table of Contents

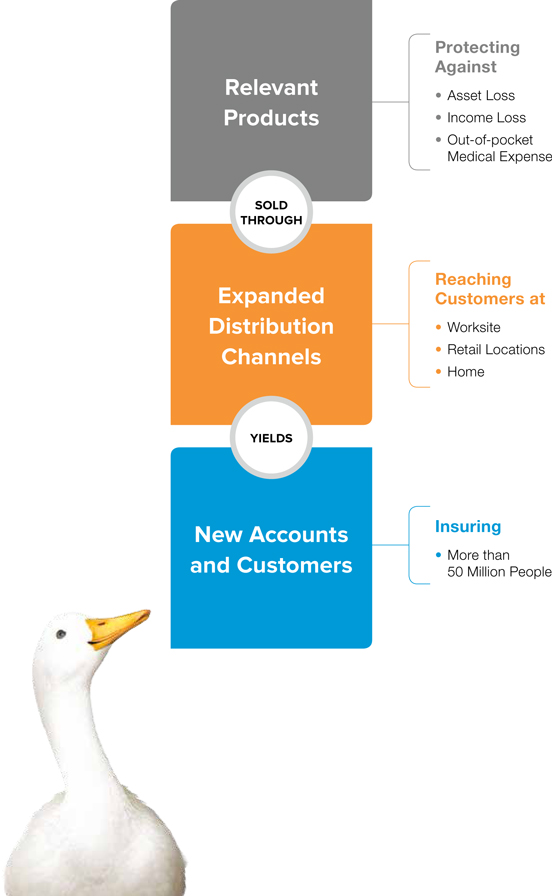

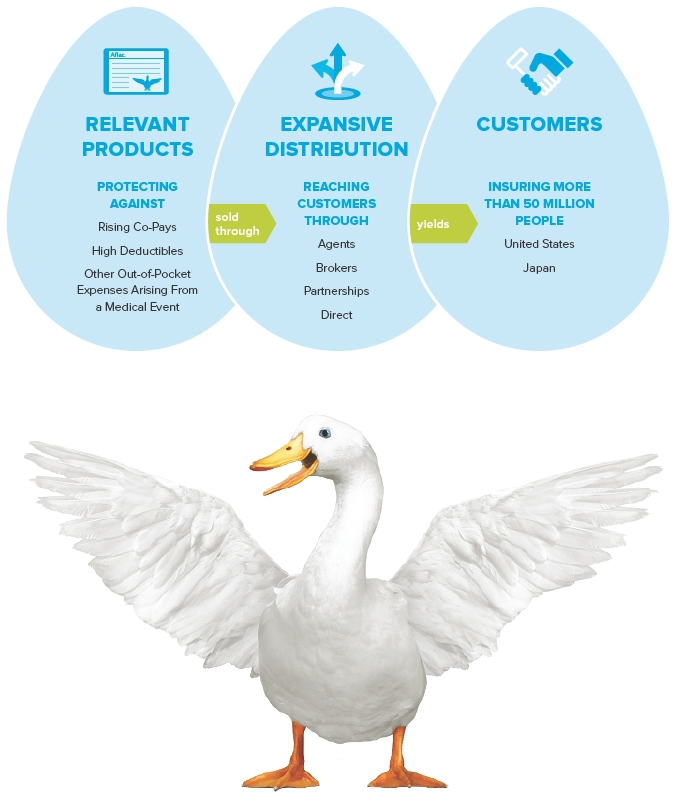

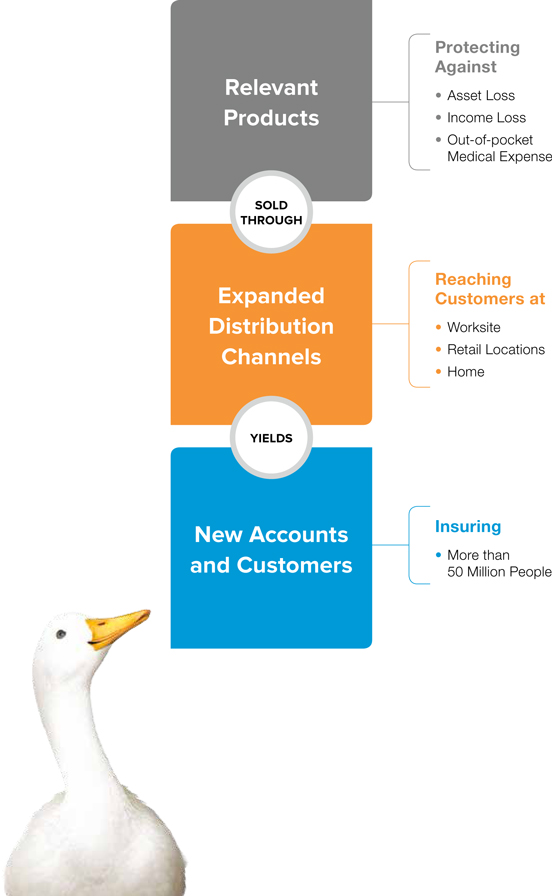

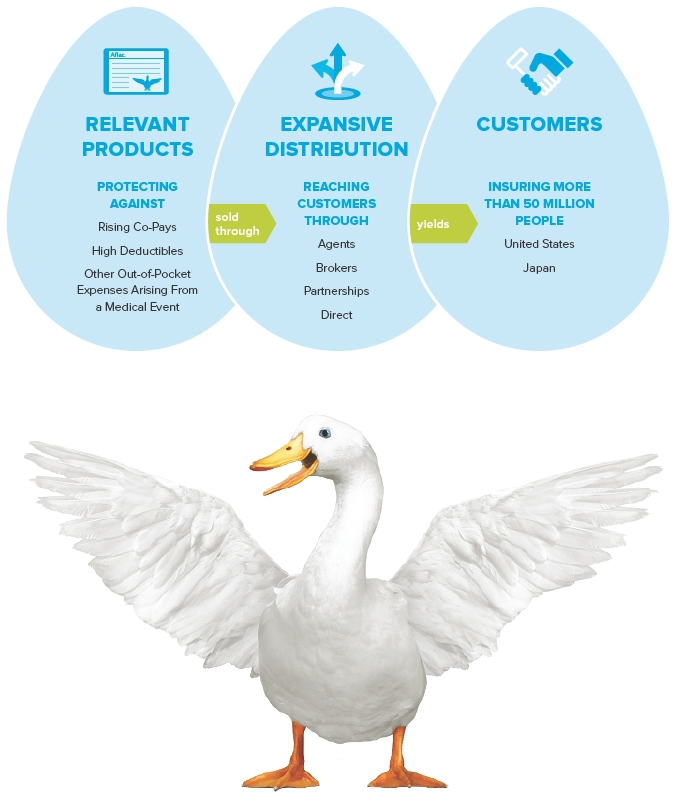

Our Strategy

Table of Contents

Our Long-Term Growth Strategy

| | March 17, 2017

Dear Fellow Shareholder:

First, let me thank you for putting your faith, confidence and resources in Aflac Incorporated. It is my pleasure to invite you to attend the 2017 Annual Meeting of Shareholders on Monday, May 1, 2017, where you can hear about Aflac Incorporated’s recent business performance and strategy for the future.

In addition, I encourage you to review the enclosed proxy materials and Aflac Incorporated’s 2016 Year in Review and Annual Report on Form 10-K to learn more about your company and our latest achievements. Then please vote your shares, even if you plan to attend the Annual Meeting. We want to be sure your shares are represented.

Looking back on the Company’s sixty-two years in business, our founding principles are as relevant today as they were in 1955. At that time, John Amos, the Company’s principal founder, was joined by his brothers, Paul and Bill, as they set out to establish a company focused on insurance products that would help ease the financial burden of getting sick or injured. Their vision and dedication laid the groundwork for an incredibly rewarding six decades of growing the business and touching millions of lives. In 2016, we made significant strides in advancing our vision ofoffering high-quality voluntary products, solutions and service through diverse distribution outlets, building upon our market-leading position to drive long-term, sustainable shareholder value.

Our Company has always managed our business for the long term while remaining laser-focused on meeting our more immediate financial objectives. Our activities are centered on protecting policyholders, growing our business and driving shareholder value. By delivering on our promise to be there when our policyholders need us most and running our business The Aflac Way, we’ve gained the trust of more than 50 million people worldwide who count on us to pay claims fairly and promptly.

As we look ahead, delivering on our promise will remain our priority because that is not only what sets our Company apart, it’s who we are. Thank you again for your faith, confidence and investment in Aflac Incorporated.

|

| | Sincerely,

Daniel P. Amos

Chairman & Chief Executive Officer

|

| AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

| | March 17, 2017

To my Fellow Shareholders:

It is an honor for me to serve as Lead Non-Management Director on your behalf, and I am fortunate to work with a diverse group of knowledgeable and experienced Board members who are committed to overseeing corporate governance and business strategy effectively and prudently. On behalf of my fellow directors, I want to share some of our key areas of focus over the past year.

Shareholder Engagement

I have worked with the Company’s Investor and Rating Agency Relations team to ensure we understand the opinions and positions of our shareholders. Our outreach has included Financial Analyst Briefings, attended by many of our shareholders, in both New York and Tokyo as well as other meetings with institutional investors. As a result of these efforts, the Board has received invaluable feedback, related to our board practices, executive compensation structure and sustainability efforts, resulting in positive dialogue and actions on behalf of you, our shareholders.

Board Composition and Succession Planning

The Board engages in a regular self-evaluation process to ensure we maintain the right balance of perspective, experience, skill sets and subject matter experts required for prudent oversight of the Company. We believe it is appropriate to maintain a balance of longer-tenured members who bring valuable, Company-specific knowledge that lends a historical perspective with newer members who bring fresh viewpoints and new ideas. Accordingly, over the last five years, we have added six new directors—most recently, Karole Lloyd, who brings a wealth of financial, accounting and auditing experience and a new, external perspective to our Board.

Corporate Activities

A major part of the Board’s responsibility is working to ensure that the Company is well-positioned in both the short and long term. In 2016 the Board oversaw a variety of corporate activities. Among other things, Aflac initiated the process of converting Aflac’s Japan branch to a subsidiary, which will better align the Company with more common global regulatory practices and corporate structures.

Executive Compensation Program

In response to feedback from investors, our long-term incentive compensation program no longer relies on annual measurements of average risk-based capital (RBC) over a three-year period, and instead incorporates a single three-year measure of RBC in 2016, together with additional new performance criteria in 2017. We believe this revision to executive compensation appropriately motivates executives to focus on the long-term growth of the Company while appropriately minimizing risk to policyholders and the Company.

With these bigger-picture topics in mind, I encourage you to review the accompanying proxy and associated materials and to vote your shares before our annual meeting on May 1, 2017. The Board looks forward to receiving and acting upon feedback from our investors, and we thank you for your support.

|

| | Sincerely,

Douglas W. Johnson

Lead Non-Management Director

|

| AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

Contents

| AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

Notice of 20172020 Annual Meeting of Shareholders

TheYou are cordially invited to the Annual Meeting of Shareholders of Aflac Incorporated (the “Company”) will be held on Monday, May 1, 2017, at 10:00 a.m. at the Columbus Museum (in the Patrick Theatre), 1251 Wynnton Road, Columbus, Georgia, for the following purposes, all of which are described in the accompanying Proxy Statement:

| Logistics |  | 1.Date and Time

toMay 4, 2020

10:00 am

|  | Place(1)

Columbus Museum (in the Patrick Theatre)

1251 Wynnton Road, Columbus, Georgia |  | Record Date

February 25, 2020 |

| | | | | | |

| | | | | | | |

| Proposal |

To elect fourteenas Directors of the Company the eleven nominees named in the accompanying Proxy Statement to serve until the next Annual Meeting and until their successors are duly elected and qualified;qualified

| | |

2.toTo consider a non-binding advisory proposal on the Company’s executive compensation (“say-on-pay”); | | |

3.to hold a non-binding advisory vote on the frequency of future say-on-pay votes;4.toTo ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2017;2020

|

Board’s Recommendation |  | FOReach of the

eleven director nominees | | |  | FOR | | |  | FOR |

5.Further Information

| PAGEto approve the adoption of the Aflac Incorporated Long-Term Incentive Plan (As Amended and Restated February 14, 2017) (“2017 LTIP”) with additional shares authorized under the 2017 LTIP;2 | | | 6.PAGEto approve the adoption of the 2018 Management Incentive Plan (“2018 MIP”); and27

| | | 7.PAGEto transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.58

|

In addition, any other business properly presented may be acted upon at the meeting and at any adjournments or postponements of the meeting.

How to Vote

It is important that you vote your shares. We encourage you to take advantage of theoffer several easy and cost-effective Internet and telephone voting that the Company offers.methods for your convenience.

The accompanying proxy is solicited by the Company’s Board of Directors (the “Board”) of the Company.Directors. The Proxy Statement and the Company’s 20162019 Year in Review and Annual Report on Form 10-K for the year ended December 31, 2016,2019, are enclosed.(2)The record date for determining which shareholders are entitled to vote at the Annual Meeting is February 22, 2017.25, 2020. Only shareholders of record at the close of business on that date will be entitled to vote at the Annual Meeting and any adjournment thereof.

Your vote is important! Even if you expect to attend the annual meeting,Annual Meeting, please vote in advance so that we may be assured of a quorum to transact business. You may vote online or by telephone, or, if you received a paper copy of this proxy statement, by signing, dating and returning your proxy card.advance. If you attend the annual meeting,Annual Meeting, you may revoke your proxy and vote in person.

By order of the Board of Directors,

J. Matthew Loudermilk

Secretary

March 17, 2017

19, 2020

Columbus, Georgia

| (1) | We continue to monitor developments regarding the coronavirus (COVID-19). In the interest of the health and well-being of our shareholders, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we make this change, we will announce the decision to do so in advance and provide details on how to participate at investors.aflac.com. |

| (2) | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 4, 2020: This Proxy Statement and the Annual Report are available at proxyvote.com. |

* Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 1, 2017. This2020 Proxy Statement and the Annual Report are available at proxyvote.com.iii

i | AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

LETTER FROM THE CHAIRMAN

AND CHIEF EXECUTIVE OFFICER

MARCH 19, 2020

Dear Fellow Shareholder:

| | | |

It is my pleasure to invite you to attend the 2020 Annual Meeting of Shareholders on Monday, May 4, 2020, where you can learn more about Aflac Incorporated’s recent business performance and strategy for the future. I encourage you to review the enclosed proxy materials and Aflac Incorporated’s 2019 Year in Review and Annual Report on Form 10-K to learn more about your company and our latest accomplishments. Then, please vote your shares, even if you plan to attend the Annual Meeting. We want to be sure your shares and your viewpoints are represented. Aflac Incorporated continues to manage the business for the long term while keeping our more immediate financial objectives top of mind. We focus on providing protection to our policyholders, growing our business, being a good corporate citizen, and driving shareholder value. In doing so, we’ve gained the trust of more than 50 million people worldwide. We don’t seek out recognition for recognition’s sake, but when we receive it, we know we’re on the right track. In 2019, we appeared on Fortune’s List of World’s Most Admired Companies for the 19th time, and Aflac Incorporated ranks No.2 in its industry for “Long-Term Investment Value.” Following are some other highlights that stand out from 2019: GROWTH

Aflac Incorporated generated $3.3 billion in net earnings or $4.43 per diluted share, up 13.2% and 17.5% from last year, respectively, and an increase in adjusted earnings per diluted share on a currency-neutral basis of 6.3% to $4.42, driven by strength in core margins. Our results are especially meaningful given the low-interest-rate environment in Japan and our extensive investments in the business to drive future earned premium growth, which will remain a critical strategic focus for 2020. CAPITAL DEPLOYMENT

When it comes to capital deployment, significant value is achieved through a balance of growth investments, stable dividend growth and disciplined, tactical stock repurchase. In December 2016, we announced our intent to unlock around $1.7 billion in excess capital drawing down Aflac’s U.S. risk-based capital (RBC) ratio closer to 500% by the end of 2019, as part of our conversion of the Japan branch to a subsidiary. I am happy to report that by the end of 2019 we succeeded in unlocking $1.75 billion in excess capital and brought Aflac’s RBC ratio to 539%. However, we believe our capital position by any measure remains robust given our risk profile, and we continue to have among the highest return on capital and lowest cost of capital in the industry. Investing in our profitable business model remains the first priority for our capital, and this includes buy to build acquisitions like our November 2019 acquisition of Argus Holdings, LLC and its subsidiary Argus Dental & Vision, Inc., a benefits management organization and national network dental and vision company. This acquisition marks our strategic entry into network dental and vision in the U.S., which we will build out over the course of 2020 and roll out nationally in 2021. We also remain committed to returning capital to our shareholders in the form of dividends and share repurchase. Accordingly, our Board of Directors increased the cash dividend 3.8% in 2019, marking the 37thconsecutive year of dividend increases. It goes without saying that we are very proud of, and want to extend, this track record. In addition, we repurchased approximately $1.6 billion, or 32 million of our shares. We will continue to seek the right balance of investing in our business, continuing our long record of dividend growth, and repurchasing stock. Through a combination of dividends and share repurchase, we returned more than $2.4 billion to our shareholders in 2019. | | | We focus on providing protection to our policyholders, growing our business, being a good corporate citizen, and driving shareholder value... [and] we’ve gained the trust of more than 50 million people worldwide. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

iv Aflac Incorporated

Table of Contents

| | | |

I’m in my 30th year as CEO of Aflac Incorporated, and since the end of August 1990 to the end of 2019, our stock has generated a total return to shareholders, including reinvested cash dividends, of more than 8,913%. This performance significantly exceeds the S&P Life & Health, S&P 500 and the Dow Jones Industrial Average over the same period. CORPORATE CULTURE OF DOING THE RIGHT THING – THE AFLAC WAY

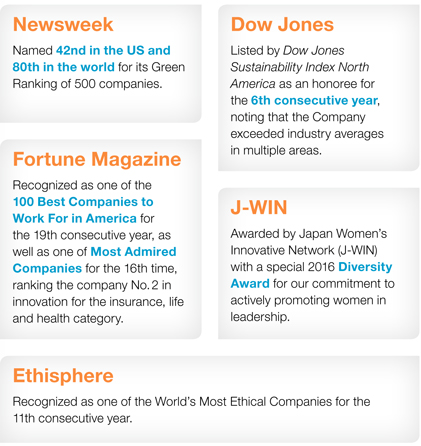

We believe that fostering and welcoming all forms of diversity in our daily operations, throughout our workforce, management team and in the composition of our Board, enhances our ability to respond to all of our constituents. Living up to the commitments we make to our customers, to our fellow employees and to all the people who rely on us is just the way we work. It’s the Aflac Way. One of the seven commitments of the Aflac Way is “Treat Everyone with Respect and Care.” One way of reinforcing this culture of understanding is by cultivating and fostering a diverse working environment and including people who represent different viewpoints. I’m proud of the fact that in the United States, 35% of our key senior leadership team are ethnic minorities or women, and 66% of our U.S. employees are women. I’m also proud of the fact that Aflac Japan achieved its goal of 30% female leadership at the company in 2019, one year ahead of schedule. By delivering on our promise to be there when policyholders need us most, paying claims fairly and promptly, and managing our business The Aflac Way, we’ve gained the trust of more than 50 million people worldwide. CORPORATE CITIZENSHIP

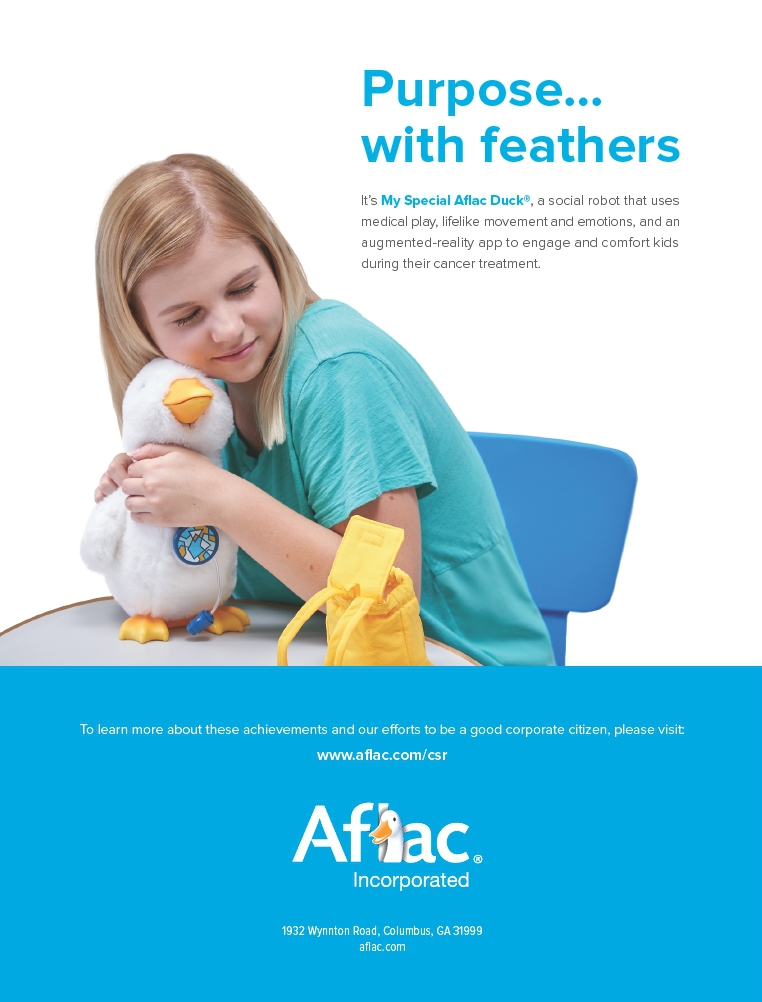

At Aflac Incorporated, we have worked to be a good corporate citizen for decades because it’s the right thing to do, and we have captured this in our Corporate Responsibility Report for more than 10 years. I don’t think it’s a coincidence that we have achieved success while focusing on doing the right things for our policyholders, shareholders, employees, sales distribution, business partners and communities. I’m proud of what we have accomplished in terms of both our social purpose and financial results, which have ultimately translated into strong, long-term shareholder return. In 2019, we followed up the initial U.S. introduction ofMy Special Aflac Duck, a smart, comforting companion that helps children feel less alone by using interactive technology during their cancer treatment, by introducing it in Japan. This special fuzzy companion helps bring comfort to children during their cancer care journey through “feeling cards” that help them express a range of emotions and a compatible web-based app that enables the children to mirror their care routines. We will continue to drive shareholder value and do so by acting ethically and giving back to the communities in which we operate. Ultimately, we believe this is a more sustainable approach to business that will continue to increase shareholder value. By remaining disciplined and focusing on doing what we do best, I believe we will continue to generate results that build long-term shareholder value. I also would like to express my gratitude to you, our shareholders, for putting your faith, confidence, and resources in Aflac Incorporated. As we look ahead, delivering on more than a promise will remain our priority, because that is not only what sets us apart, it’s who we are. Sincerely, Daniel P. Amos

CHAIRMAN AND CHIEF EXECUTIVE OFFICER  | | |

“Treat everyone with respect and care.” |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

2020 Proxy Statement v

Table of Contents

LETTER FROM THE LEAD

NON-MANAGEMENT DIRECTOR

MARCH 19, 2020

To My Fellow Shareholders:

| | | |

I am honored to have the opportunity to serve as Lead Non-Management Director, working with an experienced team of Board members who exemplify acumen in a broad range of disciplines. This team is dedicated to effectively and pragmatically overseeing Aflac Incorporated’s corporate governance and business strategy. I want to share some of the key areas on which my fellow directors and I have focused. Shareholder Engagement:As lead director, I will continue to engage our investors, gain insight into their perspectives and consider the viewpoints and positions of those who invest in our business. As a result, the Board has received valued feedback related to our Board practices and composition, executive compensation structure, and sustainability efforts, to name a few areas. This results in productive discussions and actions representing you, our shareholders. Board Composition:Just as we foster diversity within our Company operations, we foster diversity within our Board to ensure that we maintain a 360 degree view of our operations and to prompt productive and informative discussions covering the breadth and depth that our business requires. It is vital that we maintain an accomplished and cohesive Board composed of subject matter experts who are passionate about their respective areas of discipline. Our Board is made up of members whose skill sets align with the current and future needs of our Company. The Board engages in a regular self-evaluation process to ensure we maintain a cohesive, diverse, and well-constituted board of high integrity that exemplifies the right balance of perspective, experience, independence, skill sets, and subject matter experts required for prudent oversight of the Company. Over the last five years, six new directors have been added. Georgette Kiser is the most recent example of an outstanding addition to the Board, and we believe that she will prove to be a tremendous addition to the Audit and Risk Committee, too. In 2020, as a result of the Board’s annual self-evaluation process and feedback from shareholder engagements, we have determined that the Board would benefit from additional representation from Japan. We believe we found an excellent candidate in Nobuchika Mori. Commitment to Sustainability:We began establishing and defining Aflac Incorporated’s corporate purpose many years ago, even before investors began showing an interest. Establishing and defining the Company’s corporate purpose has been integral to our success. Each year, we highlight some of our efforts in Aflac Incorporated’s Year in Review and Corporate Social Responsibility reports, which I invite you to read. The Board has long recognized the importance of corporate social responsibility and sustainability in creating long-term value for shareholders. We have had a dedicated Board-level sustainability committee since 2007 and in 2017, we broadened the focus of that committee and renamed it the Corporate Social Responsibility and Sustainability Committee. In addition, we have witnessed increased interest in Environmental, Social and Governance, or ESG, from investors and others alike over the last two years. As a result, the Company has expanded and enhanced its disclosures with the launch of Aflac Incorporated’s ESG Hub, esg.aflac.com, which includes reporting using Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD) standards. The Company’s hard work to address ESG | | | As lead director, I will continue to engage our investors, gain insight into their perspectives and consider the viewpoints and positions of those who invest in our business. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

vi Aflac Incorporated

Table of Contents

| | | |

issues has been widely acknowledged. For example, in 2020, the Company was recognized by Ethisphere as one of the World’s Most Ethical Companies for the 14th consecutive year, remaining the only insurance company in the world to receive this honor every year since this award was inaugurated in 2007. Earlier this year, Bloomberg added Aflac Incorporated to its Gender-Equality Index, which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation and transparency. I think that you will agree that the Company has a good story to tell, and we are excited to share it. Risk Oversight:It is vitally important that our Board continually works to identify risks that are relevant to both the industry and to the Company. Along with carefully monitoring traditional risks associated with investments and our product risk profile, as well as maintaining strong capital ratios and managing operational risk, the Board has overseen significant advancements in information security and has enhanced our information security policy with the goal of ensuring that the Company’s information assets and data, and the data of its customers, are appropriately protected. The addition of Ms. Kiser’s expertise to our Board has added depth to our IT and information security oversight that protects all aspects of our operations. With these vital topics in mind, I encourage you to review the accompanying Proxy Statement and associated materials and to vote your shares before our annual meeting on May 4, 2020. The Board looks forward to continuing our ongoing dialogue with investors and acting upon that feedback, and we thank you for your support and the privilege of representing you and your shares. It is my pleasure, and my privilege, to serve on Aflac Incorporated’s Board, and I look forward, as a fellow shareholder, to all of the ways the Company will continue to uphold its promises. Sincerely, W. Paul Bowers

LEAD NON-MANAGEMENT DIRECTOR  | | | We began establishing and defining Aflac Incorporated’s corporate purpose many years ago, even before investors began showing an interest. Establishing and defining Aflac Incorporated’s corporate purpose has been integral to our success. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

2020 Proxy Statement vii

Table of Contents

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summaryStatement, but it does not contain all of the information that you should consider and you shouldconsider. For more information, please refer to the following:

AGENDA AND VOTING MATTERS

| To elect as Directors of the Company the eleven nominees named in this Proxy Statement | |  | FOReach nominee |

|  | PAGE2 |

| To consider a non-binding advisory proposal on the Company’s executive compensation (“say-on-pay”) | |  | FOR |

|  | PAGE27 |

| To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm | |  | FOR |

|  | PAGE58 |

Please read the entire Proxy Statement before voting. This Proxy Statement and the accompanying proxy are being delivered to shareholders on or about March 19, 2020.

For more complete information regarding the Company’s 20162019 performance, please review the Company’s Annual Report on Form 10-K. In this Proxy Statement, the terms “Company,” “we,” or “our” refer to Aflac Incorporated, and theIncorporated. The term “Aflac” refers to the Company’s subsidiary, American Family Life Assurance Company of Columbus, which operates inColumbus. The term “Aflac U.S.” refers collectively to the Company’s United States (“insurance subsidiaries: Aflac; American Family Life Assurance Company of New York (Aflac New York), a wholly owned subsidiary of Aflac; and Continental American Insurance Company (CAIC), branded as Aflac U.S.”) and as a branch inGroup Insurance. The term “Aflac Japan” refers to Aflac Life Insurance Japan (“Ltd.

viiiAflac Japan”).Incorporated

ANNUAL MEETING OF

SHAREHOLDERS

| | |

Date | Monday, May 1, 2017 | |

Time | 10:00 am | |

Place | Columbus Museum | |

| (the Patrick Theatre), | |

| 1251 Wynnton Road, | |

| Columbus, Georgia | |

Record Date | February 22, 2017 | |

AGENDA AND VOTING MATTERS

| | Board | | |

Proposal | | recommendation | | Page |

1. to elect fourteen Directors of the Company | | For each nominee | | 8 |

2. to consider a non-binding advisory proposal on the Company’s executive compensation (“say-on-pay”) | | For | | 60 |

3. to hold a non-binding vote on the frequency of future say-on-pay votes | | For every year | | 61 |

4. to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm | | For | | 64 |

5. to approve the adoption of the 2017 LTIP | | For | | 65 |

6. to approve the adoption of the 2018 MIP | | For | | 72 |

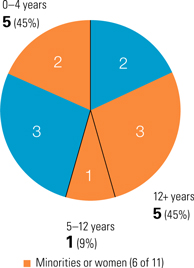

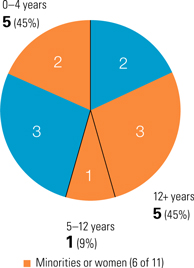

Information about our Board Members

BOARD TENURE | |

2017 Non-management Directors (11) | |

| |

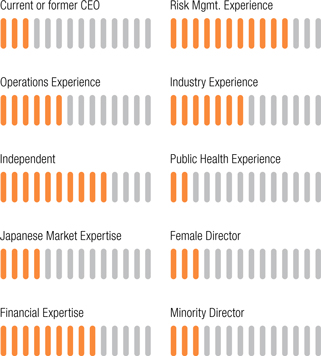

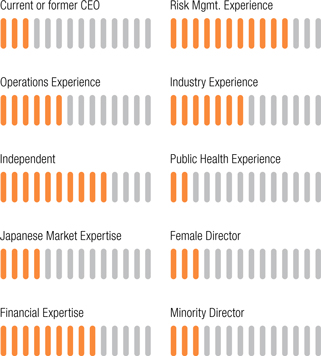

DIVERSITY OF SKILLS AND EXPERIENCE |

|

|

AFLAC INCORPORATED2017 PROXY STATEMENT

| | 1 |

Table of Contents

Proxy Summary

| |

| 01 | Proposal 1

Election of Directors |

| Each Director stands for election annually. The following provides summary information about the nominees. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh viewpoints and new ideas. |

|  | The Board of Directors recommends a vote FOR each of the eleven nominees. |  | PAGE 2 |

DIRECTOR NOMINEES

| | | | | Committee Memberships |

| | Name | IND | Age | Director

Since | AR | C | CD | CG | E | FI | CSR |

| DANIEL P. AMOS

Chairman and Chief Executive Officer,

Aflac Incorporated | | 68 | 1983 | | | | | ● | ● | |

| W. PAUL BOWERS

Lead Director

Chairman, President and Chief

Executive Officer of Georgia Power Co. | ● | 63 | 2013 | ● | | ● | | ● | | ● |

| TOSHIHIKO FUKUZAWA

President and CEO,

Chuo Real Estate Co., Ltd. | ● | 63 | 2016 | | | | | | ● | |

| THOMAS J. KENNY

Former Partner and Co-Head of

Global Fixed Income, Goldman Sachs

Asset Management | ● | 56 | 2015 | | | ● | | | ● | ● |

| GEORGETTE D. KISER

Operating Executive,

The Carlyle Group | ● | 52 | 2019 | | ● | | | | | |

| KAROLE F. LLOYD

Certified Public Accountant and retired

Ernst & Young LLP audit partner | ● | 61 | 2017 | ● | | | | ● | ● | |

| NOBUCHIKA MORI

Representative Director, Japan Financial

and Economic Research Co. Ltd. | ● | 63 | * | | | | | | | |

| JOSEPH L. MOSKOWITZ

Retired Executive Vice President,

Primerica, Inc. | ● | 66 | 2015 | ● | ● | ● | | | | |

| BARBARA K. RIMER, DrPH

Dean and Alumni Distinguished

Professor, Gillings School of Global

Public Health, University of North

Carolina, Chapel Hill | ● | 71 | 1995 | | | | ● | | | ● |

| KATHERINE T. ROHRER

Vice Provost Emeritus,

Princeton University | ● | 66 | 2017 | | ● | | ● | | | |

| MELVIN T. STITH

Dean Emeritus of the Martin J. Whitman

School of Management at

Syracuse University | ● | 73 | 2012 | | | | ● | ● | | ● |

| AR | Audit & Risk | | E | Executive | | ● | Independent |

| C | Compensation | | FI | Finance & Investment | | ● | Chair |

| CD | Corporate Development | | CSR | Corporate Social Responsibility & Sustainability | | ● | Member |

| CG | Corporate Governance | | | | |

| * | First year nominated | | | | | | |

Each Director stands for election annually. The following table provides summary information about the nominees. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh perspectives and new ideas.

| | | | | Committee Memberships |

| Name | Age | Director

Since | Ind. | Audit & Risk | Compensation | Corporate

Development | Corporate

Governance | Executive | Finance &

Investment | Sustainability |

Daniel P. Amos Chairman and Chief Executive Officer of Aflac Incorporated and Aflac | 65 | 1983 | | | | | | CHAIR | | |

Paul S. Amos II President of Aflac | 41 | 2007 | | | | | | • | • | |

W. Paul Bowers Chairman, President and Chief Executive Officer of Georgia Power Co. | 60 | 2013 | • | • | | CHAIR | | | | • |

Kriss Cloninger III President of Aflac Incorporated | 69 | 2001 | | | | | | • | | |

Toshihiko Fukuzawa President and CEO, Yushu Tatemono Co., Ltd. | 60 | 2016 | • | | | | | | | |

Elizabeth J. Hudson Retired Chief Communications Officer for the National Geographic Society | 67 | 1990 | • | | | • | | | • | CHAIR |

Douglas W. Johnson* Certified Public Accountant and retired Ernst & Young LLP audit partner | 73 | 2004 | • | CHAIR | • | | | • | | |

Robert B. Johnson Retired Senior Advisor, Porter Novelli PR | 72 | 2002 | • | | CHAIR | | • | • | | |

Thomas J. Kenny Former Partner and Co-Head of Global Fixed Income, Goldman Sachs Asset Management | 53 | 2015 | | | | | | | • | |

Charles B. Knapp President Emeritus of the University of Georgia | 70 | 1990 | • | • | | • | | | CHAIR | |

Karole F. Lloyd Certified Public Accountant and retired Ernst & Young LLP audit partner | 58 | 2017 | • | • | | | | | | |

Joseph L. Moskowitz Retired Executive Vice President, Primerica, Inc. | 63 | 2015 | • | • | • | • | | | | |

Barbara K. Rimer, DrPH Dean and Alumni Distinguished Professor, Gillings School of Global Public Health, University of North Carolina, Chapel Hill | 68 | 1995 | • | | | | CHAIR | • | | • |

Melvin T. Stith Dean Emeritus of the Martin J. Whitman School of Management at Syracuse University | 70 | 2012 | • | • | | | • | | | |

*Douglas W. Johnson is also the Lead Non-Management Director.

2020 Proxy Statement ix

Table of Contents

Proxy Summary

2016 Business HighlightsCORPORATE GOVERNANCE HIGHLIGHTS

| ✓ | Annual director elections |

| ✓ | Majority vote standard for director elections |

| ✓ | Independent Lead Director |

| ✓ | Active and responsive shareholder engagement process |

| ✓ | Annual Board evaluations, including individual director interviews |

| ✓ | Shareholder ability to call special meetings |

| ✓ | Shareholder right of proxy access |

| ✓ | Robust CEO succession planning process |

| ✓ | Director mandatory retirement age |

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY HIGHLIGHTS

| We carefully consider the impact our actions will have on our communities and our planet – not only today, but in the years to come. | | We are invested in an inclusive and equitable work environment. |

We are proud of the accolades we have received, a handful of which are listed below, and we invite you to read Aflac’s Year in Review and Corporate Social Responsibility reports to learn more about our initiatives.

| ● | Fortune’s 100 Best Companies to Work for in America (20thconsecutive year) |

| ● | Fortune’s Most Admired Companies (19thtime) |

| ● | Ethisphere’s World’s Most Ethical Companies (14thconsecutive year) |

| ● | Named to Dow Jones Sustainability Indexes (8thconsecutive year) |

| ● | Bloomberg’s Gender-Equality Index, which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation and transparency. |

x Aflac Incorporated

Table of Contents

In 2016,Proxy Summary

| |

| 02 | Proposal 2

Executive Compensation (“Say-on-Pay”) |

| We are committed to achieving a high level of total return for our shareholders. From the end of August 1990, when Daniel P. Amos was appointed the CEO, through December 31, 2019, the Company’s total return to shareholders, including reinvested cash dividends, has exceeded8,913%, compared with 2,111% for the Dow Jones Industrial Average, 1,748% for the S&P 500 Index, and 1,000% for the S&P 500 Life & Health Insurance Index over the same period. |

|  | The Board of Directors recommends a vote FOR our executive compensation. |  | PAGE 27 |

EXECUTIVE COMPENSATION HIGHLIGHTS Our executive compensation philosophy is to provide pay that is aligned with the Company’s results. We believe this is the most effective method for creating shareholder value and it has played a significant role in making the Company delivered strong operating results.an industry leader. Our pay-for-performance compensation program generally targets market median positioning and delivers the majority of direct compensation through performance-based elements. This ensures proper alignment with our shareholders and ties compensation for named executive officers to the Company’s performance.

The Company’s executive compensation program reflects our corporate governance best practices principles:

●✓

| The Board’s independent Compensation Committee oversees the program. |

| ✓ | The Compensation Committee retains an independent compensation consultant that reports only to that Committee. |

| ✓ | The independent compensation consultant briefs the full Board annually on CEO pay and performance alignment. |

| ✓ | We were the first public company in the U.S. to voluntarily provide shareholders with a say-on-pay vote–three years before such votes became mandatory. |

| ✓ | Executive officers and Directors may not enter into 10b5-1 plans unless approved by the Compensation Committee or pledge the Company’s stock. |

| ✓ | All employees are prohibited from hedging Company stock. |

| ✓ | Executive officers and Directors have been subject to stock ownership guidelines for almost two decades. |

| ✓ | We have had a clawback policy since 2007. |

| ✓ | We do not provide for change-in-control excise tax gross-ups. |

| ✓ | All employment agreements contain double trigger change-in-control requirements. |

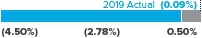

| | 2019 BUSINESS HIGHLIGHTS |

| | In 2019, the Company delivered strong operating results. |

| | NET EARNINGS

$3.3B(13.2%) Operating▲ |

| | EPS

17.5%▲ | ADJUSTED EPS*

6.3%▲ |

| | RETURN ON EQUITY

12.6%▲ |

| | ADJUSTED RETURN ON EQUITY

(“AROE”)*

15.1%▲ |

| | REPURCHASED SHARES

$1.6B |

| | CASH DIVIDEND

3.8%▲ |

| | 3 YEAR TSR

+62.5% |

| ● | U.S. and Japan sales(1)were down 1.3% and 16.9%, respectively. |

| ● | Total revenues increased 2.5% to $22.3 billion. Total adjusted revenues increased 1.2% to $22.3 billion reflective of continued growth of the inforce business in both United States and Japan. Total adjusted revenues on a currency-neutral basis* increased .4% to $22.1 billion. |

| ● | We acquired Argus Holdings, LLC which was a key step in the Company’s buy-to-build strategy to deliver best-in-class network dental and vision products to employers and unique solutions to distribution partners. Along with entering a growth market, we believe this portfolio expansion will increase producer productivity and assist with recruiting and retaining agents and expand broker markets. |

| * | Adjusted earnings per diluted share excluding foreign currency effect1, increased 4.7% over 2015, meeting our objective for the 27th consecutive year.We believe operating earnings per diluted share,excluding foreign currency effect, continues to be one of the best measures of our performance and a key driver of shareholder value.● Combined, we generated $2.5 billion inimpact, total new annualized premium sales in the United States and Japan, driven by a 4.1% increase in third sector sales (which includes cancer and medical insurance)in Japan.

● Revenues rose 8.1% to $22.6 billion. Total operating revenues on a currency-neutral basis1 rose 1.0% to $21.0 billion, reflecting growth in our premium income from our growing business.

| | ● As of December 31, 2016, our capital ratios remained strong. Risk-based capital ratio was 894%. Solvency margin ratio, the principal capital adequacymeasure in Japan, was 945%.

● We have started work on converting our Japanese operations from a branch to a subsidiary form. Converting to this structure will allow the Company to further align with emerging global best practices in the financial services sector and preserve existing state regulatory oversight in the United States while also ensuring that our financial profile is as strong asit is today.

|

1 | Operating earnings per diluted share excluding foreign currency effect, operatingadjusted revenues on a currency-neutral basis, and operating return on shareholders’ equity excluding foreign currency effectAROE, are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). See the Appendix C to this Proxy Statement for a descriptiondefinitions of these non-GAAP measures and reconciliation to the nearestmost comparable GAAP measure, as applicable.financial measure. |

| (1) | As defined in Item 1. Business in the Company’s 2019 Annual Report on Form 10-K. |

2020 Proxy Statement xi

AFLAC INCORPORATED2017 PROXY STATEMENT

| | 3 |

Table of Contents

Proxy Summary

Executive Compensation Highlights2019 EXECUTIVE COMPENSATION

Our compensation philosophy, which extends to every employee level at the Company, is to provide pay that is directly linked to the Company’s results. We believe this is the most effective method for creating shareholder value and that it has played a significant role in making the Company an industry leader.

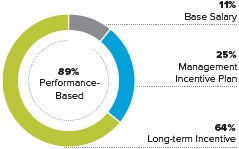

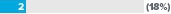

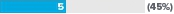

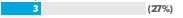

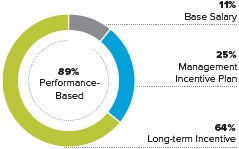

The Company’s executivetotal target direct compensation programs reflectmix for 2019 for (1) our corporate governance best practices principles:CEO and (2) our CEO together with our other NEOs is illustrated in the following charts, and reflects the performance-based nature of our compensation program:

● The Board’s independent Compensation Committeeoversees the program.

● The Compensation Committee retains an independent compensation consultant that reports only to that committee.

● For the past nineteen years, all of the CEO’s total direct compensation has been determined based on the Company’s financial performance and total shareholder return performance compared to our peers. The Compensation Committee regularly evaluates this formula to ensure it remains appropriate.

● The independent compensation consultant reports annually to the full Board of Directors on CEO pay and performance alignment.TARGET COMPENSATION MIX

| | ●CEO + NEOs TARGET COMPENSATION MIX We were the first public company in the U.S.to voluntarily provide shareholders with asay-on-pay vote–three years before such votes became mandatory.

● Executive officers and Directors may not enter into 10b5-1 plans (unless approved by the Compensation Committee) or hedge or pledge the Company’s stock.

● Executive officers and Directors have been subject to stock ownership guidelines for almost two decades.

● We have had a clawback policy since 2007.

● We do not pay change-in-control excise tax gross-ups.

● All employment agreements contain double triggerchange-in-control requirements.

|

| |  |

Executive Compensation Program ChangesRECENT SAY-ON-PAY VOTES

From our first voluntary “say-on-pay” advisory vote in 2008 until 2013,We are pleased that, for the Company received endorsement rates frompast two consecutive years, 96% of our shareholders that averaged more than 96%.

In recent yearsvoting on the support for our executive compensation program has been less favorable; approximately 86% of our shareholderssay-on-pay proposal voted in favor of our 2016 say-on-pay proposal. In addition, consistent withexecutive compensation. We believe this continued support reflects favorably on changes we have made to our executive compensation program over the past practice, the Company engaged in shareholder outreach efforts throughout 2016. The Compensation Committee incorporated thefew years to more tightly link compensation metrics to our business strategy while incorporating feedback received from these conversations into its regular review of compensation practices, and also conducted a thorough analysis of best practices. As a result, the Compensation Committee has modified our compensation plans, as further discussed in this proxy statement.

Based on the feedback resulting from the Company’s shareholder engagement and analysis, in 2016 the LTI award for the CEO continued under the current structure and process: the contingent PBRS grant made in February 2016 was trued up as of December 31, 2016, based on the Company’s relative financial and relative TSR performance versus our peers. Beginning in 2017, the Company will grant the CEO’s entire annual LTI award at a competitive level considering peer market data, the Company’s performance, and the tenure and performance of the CEO.

The Compensation Committee also has approved changes to the management incentive program and the LTI award program for executives other than the CEO. The management incentive program will reflect fewer metrics, taking into account a new definition of operating earnings. Additionally, the Aflac Japan direct premium metric will focus on third sector business in Japan. The 2017 LTI program will follow a simplified approach recommended by our independent compensation consultant that is consistent with long-term incentive plans offered by our peers. See “Program Changes for 2017,” which begins on page 42.

shareholders. We work hard to ensure we remain current, continue to leadimplement best practices in executive compensation best practices, and remainwhile staying focused on performance-based program elements that align with shareholder concerns. Accordingly, weinterests. We will continue to review our reviewcompensation program each year to determine if additional changes should be made in 2017.are warranted.

Pay-for-Performance

Our compensation program targets market median positioning and delivers the majority of that compensation through performance-based compensation elements. This ensures proper alignment with our shareholders and ties the ultimate value delivered to named executive officers (“NEOs”) to the Company’s performance.

4 | Learn more in theCompensation Discussion & Analysisunder the heading “Outcome of 2019 Say-on-Pay Vote”. |

| |

| 03 | Proposal 3

Ratification of Auditors |

| In February 2020, the Audit and Risk Committee voted to appoint KPMG LLP, an independent registered public accounting firm, to perform the annual audit of the Company’s consolidated financial statements for fiscal year 2020, subject to ratification by the shareholders. |

|  | The Board of Directors and the Audit and Risk Committee recommend a vote FOR the ratification of the selection of KPMG LLP. |  | PAGE 58 |

xii Aflac Incorporated

Table of Contents

2020 Proxy Statement 1

Table of Contents

Solicitation and Revocation of ProxyCorporate Governance Matters

This Proxy Statement is furnished to shareholders in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Shareholders to be held on Monday, May 1, 2017, and any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders and described in detail herein. The Annual Meeting will be held at 10 a.m. at the Columbus Museum (in the Patrick Theatre), 1251 Wynnton Road, Columbus, Georgia.

The mailing address of our principal executive offices is Aflac Incorporated, 1932 Wynnton Road, Columbus, Georgia 31999.

All properly executed proxies returned to the Company will be voted in accordance with the instructions contained thereon. If you return your proxy with no voting instructions indicated, the proxy will be voted FOR the election of all Director nominees named in this Proxy Statement, FOR approval of Proposals 2 and 4 through 6, for holding advisory votes on executive compensation every “year” (Proposal 3), and according to the discretion of the proxy holders on any other matters that may properly come before the Annual Meeting or any postponement or adjournment thereof. If you are a shareholder of record, you also may submit your proxy online or by telephone in accordance with the procedures set forth in the enclosed proxy, or you may vote in person at the Annual Meeting. Shareholders can revoke a proxy at any time before it is exercised by giving written notice to that effect to the Secretary of the Company or by submitting a later-dated proxy or subsequent internet or telephonic proxy. Shareholders who attend the Annual Meeting may revoke any proxy previously granted and vote in person orally or by written ballot.

This Proxy Statement and the accompanying proxy are being delivered to shareholders on or about March 17, 2017.

Solicitation of Proxies

The Company will pay the cost of soliciting proxies. The Company will make arrangements with brokerage firms, custodians, and other fiduciaries to send proxy materials to their customers, and will reimburse these entities for the associated mailing and related expenses. In addition, certain officers and other employees of the Company may solicit proxies by telephone and by personal contacts, but those individuals will not receive additional compensation for those efforts. The Company has retained Georgeson LLC to assist in the solicitation of proxies for a fee of $9,500, plus reimbursement of reasonable out-of-pocket expenses.

Proxy Materials and Annual Report

As permitted by the SEC rules, we are making these proxy materials available to our shareholders via the internet. Accordingly, we have mailed to most of our shareholders a notice about the internet availability of this Proxy Statement and the Company’s 2016 Year in Review and Annual Report on Form 10-K for the year ended December 31, 2016 (together, the “Annual Report”) instead of paper copies of those documents. The notice contains instructions on how to access those documents online, how to vote at proxyvote.com, and how to request and receive a paper copy of our proxy materials, including this Proxy Statement and our Annual Report. If you select the online access option for the Proxy Statement, Annual Report, and other account mailings throughaflinc®, the Company’s secure online account management system, you will receive electronic notice of availability of these proxy materials. If you do not receive a notice and did not already elect online access, you will receive a paper copy of the proxy materials by mail. We believe providing online access to our critical documents will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

AFLAC INCORPORATED2017 PROXY STATEMENT

| |

5 | Proposal1

Election of Directors |

Table of Contents

Solicitation and Revocation of Proxy

Multiple Shareholders Sharing the Same Address

The Company is sending only one Annual Report and one Proxy Statement or notice of availability of these materials to shareholders who consented and who share a single address. This is known as “householding.” However, any registered shareholder who wishes to receive a separate Annual Report or Proxy Statement may contact Shareholder Services by phone at (800) 227-4756, by email at shareholder@aflac.com, or by mail at the address set forth above. If you receive multiple copies of the Annual Report or Proxy Statement or notice of availability of these materials, you may request householding by contacting Shareholder Services (if you are a registered shareholder) or by contacting the holder of record (if you own the Company’s shares through a bank, broker, or other holder of record).

Description of Voting Rights

The Company believes that long-term shareholders should have a greater say in our success. Accordingly, the Company’s Articles of Incorporation provide that each share of the Company’s Common Stock is entitled to one vote until it has been held by the same beneficial owner for a continuous period of longer than 48 months prior to the record date of the meeting, at which time each share becomes entitled to ten votes. If a share is transferred by gift, devise, or bequest, or otherwise through the laws of inheritance, descent, or distribution from the estate of the transferor, or by distribution to a beneficiary of shares held in trust, the transferee is deemed to be the same beneficial owner as the transferor for purposes of determining the number of votes per share. Shares acquired as a direct result of a stock split, stock dividend, or other distribution with respect to existing shares are deemed to have been acquired and held continuously from the date on which the underlying shares were acquired. Shares of Common Stock acquired pursuant to the exercise of a stock option are deemed to have been acquired on the date the option was granted.

Shares of Common Stock held in “street” or “nominee” name are presumed to have been held for less than 48 months and are entitled to one vote per share unless this presumption is rebutted by evidence to the contrary. If you wish to demonstrate that you have held your Common Shares in street name for longer than 48 months, please complete and execute the affidavit appearing on the reverse side of your proxy. The Board of Directors may require evidence to support the affidavit.

Quorum and Vote Requirements

Holders of record of Common Stock at the close of business on February 22, 2017, will be entitled to vote at the Annual Meeting. At that date, the number of outstanding shares of Common Stock entitled to vote was 401,177,209. According to the Company’s records, this represents the following voting rights:

| Number of shares | | Votes per share | | Yields this many votes | |

| 371,012,282 | @ | 1 | = | 371,012,282 | |

| 30,164,927 | @ | 10 | = | 301,649,270 | |

| 401,177,209 | | Total | | 672,661,552 | |

If all of the outstanding shares were entitled to ten votes per share, the total number of possible votes would be 4,011,772,090. However, for purposes of this Proxy Statement, we assume that the total number of votes that may be cast at the Annual Meeting will be 672,661,552.

The holders of a majority of the voting rights entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of such business that comes before the meeting. Abstentions are counted as “shares present” for purposes of determining whether a quorum exists. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Broker non-votes are counted as “shares present” at the Annual Meeting for purposes of determining whether a quorum exists.

6 | Each Director stands for election annually. The following provides summary information about the nominees. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh viewpoints and new ideas.

|

| | AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

Solicitation and Revocation of Proxy

The following table shows the voting requirements for each proposal we expect at the Annual Meeting.

Proposal | Vote required to Pass | EffectThe Board of abstentions and broker non-votes |

Uncontested election of directors | Votes cast forDirectors recommends a nominee exceed votes cast against that nominee | Abstentions and broker non-votes are not counted as votes cast and have no effect |

voteAdvisory vote on frequency of future say-on-pay votesFOR | The frequency (every year, every two years, or every three years) that attains the most votes will prevail | Abstentions and broker non-votes are not counted as votes cast and have no effect |

Ratification each of the Independent Registered Public Accounting Firmeleven nominees. | Majority of the votes cast | Abstentions are not counted as votes cast and have no effect. Brokers and other nominees may vote without instructions, so we do not expect broker non-votes. |

Advisory say-on-pay, 2017 LTIP, and 2018 MIP | Majority of the votes cast | Abstentions and broker non-votes are not counted as votes cast and have no effect |

If a nominee who is already serving as a Director is not re-elected at the Annual Meeting in an uncontested election, Georgia law provides that Director would continue to serve on our Board as a “holdover director.” However, our Director Resignation Policy provides that holdover directors must tender a resignation to our Chairman of the Board. The Corporate Governance Committee will consider such resignation and recommend to the Board whether to accept or reject it. In considering whether to accept or reject the tendered resignation, the Corporate Governance Committee will consider all factors its members deem relevant, including the stated reasons why shareholders voted against such Director, the qualifications of the Director, and whether the resignation would be in the best interests of the Company and its shareholders. The Board will formally act on the Corporate Governance Committee’s recommendation no later than ninety days following the date of the Annual Meeting at which the election occurred. The Company will, within four business days after such decision is made, publicly disclose that decision in a Form 8-K filed with the SEC, together with a full explanation of the process by which the decision was made and, if applicable, the reasons for rejecting the tendered resignation. If a nominee who was not already serving as a Director is not elected at the Annual Meeting, that nominee would not become a Director or a holdover director.

In a contested election at an annual meeting of shareholders (meaning the number of nominees exceeds the number of Directors to be elected), the standard for election of Directors would be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of Directors.

Effect of Not Casting a Vote

If you hold your shares in street name, it is critical that you provide voting instructions to the record owner. Otherwise, your shares will not count in any proposal other than Proposal 4—Ratification of the Independent Registered Public Accounting Firm. Your bank or broker is not permitted to vote without your instructions in the election of Directors, on the advisory vote on executive compensation, on the advisory vote on the frequency of future say-on-pay votes, or on the two proposals to approve our compensation plans. Broker non-votes on these matters will have no effect on the outcome of the proposals. Your bank or broker may vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 4).

If you are a shareholder of record and you do not return your proxy card, no votes will be cast on your behalf on any item of business at the Annual Meeting. If you return the proxy card but do not give voting instructions, your proxy will be voted FOR the election of all Director nominees named in this Proxy Statement, FOR approval of Proposals 2 and 4 through 6, for “every year” frequency for say-on-pay votes (Proposal 3), and according to the discretion of the proxy holders on any other matters that may properly come before the Annual Meeting or any postponement or adjournment thereof.

AFLAC INCORPORATED2017 PROXY STATEMENT

| | 7 |

Table of Contents

Proposal 1:Election of Directors

The Company proposes that the following fourteeneleven individuals be elected to the Board of Directors.Board. These individuals have been nominated by the Board’s Corporate Governance Committee of the Board of Directors and, ifCommittee. If elected, they are willing to serve until the nextfor a one-year term expiring at our 2021 Annual Meeting of Shareholders andShareholders. Each Director will hold office until their successors havehis or her successor has been elected and qualified.qualified or until the Director’s earlier death, resignation or removal. The people named in the accompanying proxy (or their substitutes) will vote to elect these nominees unless specifically instructed to the contrary. However, if any nominee becomes unable or unwilling to serve or is otherwise unavailable for election, the people named in the proxy (or their substitutes) will have discretionary authority to vote or to refrain from voting on any substitute nominee. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with an historical perspective, and newer members, who bring fresh perspectives and new ideas.

All but one of the nominees introduced below are currently members of our Board. Ms. Lloyd was appointed as a director, uponUpon the recommendation of the Corporate Governance Committee, Mr. Nobuchika Mori has been nominated to serve on January 6, 2017. Ms. Lloydthe Board. Mr. Mori was recommended for the Board by the Chairman of the AuditBoard most notably for his regulatory expertise and Risk Committee.financial acumen gathered over a three-plus decade career in Japan and internationally as a financial regulator, including from July 2015-July 2018, as Commissioner of Japan’s Financial Services Agency.

DIRECTOR SKILLS SUMMARYWe expect all of our Directors to have a demonstrated ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company. As shown below, our nominees have a range of skills and experience in areas that are critical to our industry and our operations.

| | | | Japanese | | | | |

| Current or | Operations | | Market | Financial | Risk Mgmt. | Industry | Public Health |

Name | former CEO | Experience | Independent | Experience | Expertise | Experience | Experience | Experience |

Daniel P. Amos | · | · | | · | | · | · | |

Paul S. Amos II | | · | | · | | · | · | |

W. Paul Bowers | · | · | · | · | · | · | | |

Kriss Cloninger III | | · | | | · | · | · | |

Toshihiko Fukuzawa | · | | · | · | · | · | · | |

Elizabeth J. Hudson | | | · | | | · | | |

Douglas W. Johnson | | | · | | · | | · | |

Robert B. Johnson | | | · | | | · | | · |

Thomas J. Kenny | | · | | | · | · | | |

Charles B. Knapp | | | · | | · | · | | |

Karole F. Lloyd | | | · | | · | | | |

Joseph L. Moskowitz | | · | · | | · | · | · | |

Barbara K. Rimer, DrPH | | | · | | | | · | · |

Melvin T. Stith | | | · | | · | · | | |

2 Aflac Incorporated

FOR | The Board of Directors recommends a vote“for”the election of each of the following nominees as directors. |

8 | | AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

Corporate Governance Matters

Proposal 1: Election of DirectorsBOARD COMPOSITION

Director Skills Summary and The Link to Our Strategy

| Skills and Experience |  |  |  |  |  |  |  |  |  |  |  |

| Independent | | | | | | | | | | | |

| Marketing and Public Relations | | | | | | | | | | | |

| Current or former CEO | | | | | | | | | | | |

| Operations Experience | | | | | | | | | | | |

| Japanese Market Experience | | | | | | | | | | | |

| Investment and Financial Expertise | | | | | | | | | | | |

| Regulatory and Risk Mgmt. Experience | | | | | | | | | | | |

| Industry Experience | | | | | | | | | | | |

| Public Health Experience | | | | | | | | | | | |

| Digital/Cyber Security Experience | | | | | | | | | | | |

Director Nominees

AGE

65

DIRECTOR SINCE

1983

COMMITTEES

Executive(Chair)

| Daniel P. Amos

CHAIRMAN, CHIEF EXECUTIVE OFFICER OF AFLAC INCORPORATED | | | |  ChairmanAGE

68

DIRECTOR SINCE

1983 COMMITTEES

Executive (Chair) Finance and Chief Executive Officer of Aflac Incorporated and AflacInvestment |

Mr. Amos has been Chief Executive Officer of the Company and Aflac since 1990, and Chairman since 2001.2001, was President of Aflac from July 2017 to May 2018, and was President of Aflac Incorporated from February 2018 through December 2019. He has spent 3840 years in various positions at Aflac. | | | |

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Institutional Investormagazine has named Mr. Amos one of America’s Best CEOs in the life insurance category five times. Additionally,Harvard Business Review has named Mr. Amos was named among the World’s Best Performing CEOs by Harvard Business Review in 2015 and 2016.each of the past four years.CR Magazinerecently honored him with a Lifetime Achievement Award for his dedication to corporate responsibility. Mr. Amos’ experience and approach deliver insightful expertise and guidance to the Board of Directors on topics relating to corporate governance, people management, and risk management. | | ·OTHER BOARD OR LEADERSHIP POSITIONS

●Synovus Financial Corp.(2001-2011)

(2001 to 2011)·●Southern Company(2000-2006)

(2000 to 2006)

|

AGE

41

DIRECTOR SINCE

2007

COMMITTEES

Executive

Finance and Investment

| Paul S. Amos IIPresident of Aflac

Mr. Amos has been President of Aflac since January 2007. He was Chief Operating Officer of Aflac U.S. from February 2006 until July 2013, and executive vice president, U.S. Operations, from January 2005 until January 2007. Since January 2008, Mr. Amos has also played a leadership role in Aflac Japan sales and marketing efforts. After assuming reporting responsibilities for Aflac Japan in 2013, Mr. Amos relocated to Tokyo for two years to oversee the Aflac Japan operation locally.

|

SKILLS AND RECOGNITION | | |

Mr. Amos brings to the Board a deep knowledge of insurance sales, which forms the core of our business, as well as more than ten years of experience at the Company in various leadership roles. Furthermore, his extensive familiarity with the Japanese culture and insurance industry brings a unique perspective to the Board. | |

|

AFLAC INCORPORATED2017 PROXY STATEMENT

| | | | | |

2020 Proxy Statement 3

Table of Contents

Proposal 1: Election of Directors

Corporate Governance Matters

AGE

60

DIRECTOR SINCE

2013

COMMITTEES

Corporate

Development(Chair)

Audit and Risk* Sustainability

*Financial Expert

| W. Paul Bowers

CHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER OF GEORGIA POWER CO. |

| | |

Chairman, PresidentINDEPENDENT

LEAD NON-MANAGEMENT INDEPENDENT DIRECTOR AGE

63 DIRECTOR SINCE

2013 COMMITTEES

Corporate Development (Chair) Audit and Chief Risk* Corporate Social Responsibility & Sustainability Executive Officer of Georgia Power Co. *Financial Expert

|

Mr. Bowers has been chairman, president and chief executive officer of Georgia Power, the largest subsidiary of Southern Company, a gas and electricity utility holding company, since 2011. Before that, Mr. Bowers served as chief financial officer of Southern Company from 2008 to 2010. Previously, he served in various senior executive positions across Southern Company in Southern Company Generation, Southern Power, and the company’s former U.K. subsidiary, where he was president and chief executive officer of South Western Electricity LLC/Western Power Distribution. |

| | |

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Mr. Bowers brings to the Board a valuable and unique perspective from his considerable financial knowledge as a former chief financial officer;knowledge; national and international business experience, including experience in Japan and operating in a highly regulated industry; and expertise in corporate development and managing the evolving risks associated with cyber security. | | ·OTHER BOARD OR LEADERSHIP POSITIONS

●Chair, Atlanta Committee for Progress(2016)

(since 2016)·●Nuclear Electric Insurance Ltd.

(since 2009); current Chairman

·●Board of Regents of the UniversitySystem of Georgia (since 2014)(2014-2018)·●Federal Reserve Bank of Atlanta’s

Energy Policy Council (since 2008)(2008-2018)

|

AGE

69

DIRECTOR SINCE

2001

COMMITTEES

Executive

| Kriss Cloninger III●President of Aflac IncorporatedMr. Cloninger has been President of the Company since 2001, and before that was executive vice president since 1993. He served as Chief Financial Officer from 1992 to 2015, and Treasurer from 1993 to 2015. Prior to joining the Company in 1992, he was a principal in KPMG’s insurance actuarial practice and served as a consultant to Aflac beginning in 1977. Mr. Cloninger will retire as President on December 31, 2017.

|

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Mr. Cloninger has been named Best CFO in America in the insurance/life category by Institutional Investor magazine three times. His financial acumen and expertise in the Company’s operations and corporate strategy bring a unique economic perspective to our Board of Directors.Brand Industrial Holding, Inc, (since 2019) and Audit Committee Chair (since 2019) |

| | ●TotalSystem Services, Inc. (TSYS)

(since 2004)

●TupperwareBrands Corporation

(since 2003)

●Fellowof the Society of Actuaries

|

| | | | | |

10Toshihiko Fukuzawa

PRESIDENT AND CEO OF CHUO REAL ESTATE CO., LTD |

| | |

AFLAC INCORPORATEDINDEPENDENT

AGE

2017 PROXY STATEMENT63 DIRECTOR SINCE

2016 COMMITTEES

Finance and Investment |

Table of Contents

Proposal 1: Election of Directors

AGE

60

DIRECTOR SINCE

2016

| Toshihiko FukuzawaPresident and CEO of Yushu Tatemono Co., Ltd

Mr. Fukuzawa has been the president and chief executive officer of Chuo Real Estate Co., Ltd., a real estate development and leasing company in Japan, since July 2018. Previously, he was the president and chief executive officer of Yushu Tatemono Co., Ltd. since, also a real estate development and leasing company in Japan, from June 2015 where he also serves as a representative director.to June 2018. He served as deputy president and a representative director at Mizuho Trust & Banking Co., Ltd. from April 2013 to March 2015, managing executive officer and head of the IT System Group at Mizuho Bank Ltd. from June 2011 to March 2013, and deputy president and a representative director at Mizuho Information & Research Institute Inc. from June 2009 to June 2011. BetweenFrom 2002 andto 2009, he held executive officer and general manager positions at Mizuho Bank, Ltd. and affiliated companies, part of Mizuho Financial Group, Inc. which was formed in a merger between his former employer, Dai-Ichi Kangyo Bank, Ltd., and two other banks. Mr.Inc.Mr. Fukuzawa held various positions of increasing responsibility at Dai-Ichi Kangyo Bank, Ltd., from 1979 until 2002.which he joined in 1979. | | | |

SKILLS AND RECOGNITION | | |

Over a 36-year career as a professional banker in Japan, Mr. Fukuzawa has gained extensive business and IT knowledge and experience with a wide range of Japanese financial services institutions, including insurance companies. He provides the Board with valuable insight and expertise relevant to the Company’s Japanese business. |

| |

|

| | | | | |

4 Aflac Incorporated

AGE

67

DIRECTOR SINCE

1990

COMMITTEES

Sustainability (Chair)

Corporate

Development

Finance and

Investment

| Elizabeth J. HudsonRetired Chief Communications Officer for the National Geographic Society

Ms. Hudson was the chief communications officer of the National Geographic Society from 2014 to 2015, and previously served as the senior communications executive since 2000. She oversaw philanthropic development and was responsible for all communications and public affairs initiatives undertaken by the National Geographic Society and its subsidiaries, including media and public relations, community engagement and social media, brand stewardship, employee communications, and related marketing-communications activities.

|

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Ms. Hudson has more than forty years of experience serving on the executive management teams of several national and international organizations, including publicly traded entities and one of the world’s largest scientific and research organizations. She brings extensive experience in strategic corporate communications, including financial and crisis communications management, and in marketing initiatives. She also has expertise in developing and articulating sustainability programs. | | ●Co-chair, Washington chapter of Women Corporate Directors (since 2010) |

AFLAC INCORPORATED2017 PROXY STATEMENT

| | 11 |

Table of Contents

Proposal 1: Election of Directors

Corporate Governance Matters

AGE

73

DIRECTORSINCE

2004

LEAD NON- MANAGEMENT

DIRECTOR

COMMITTEES

Audit and Risk*(Chair)

Compensation

Executive

*Financial Expert

| Douglas W. JohnsonCertified Public Accountant and retired Ernst & Young LLP

audit partner

Mr. Johnson is a certified public accountant who retired as an Ernst & Young LLP audit partner in 2003. He spent the majority of his career focusing on companies in the life, health and property/casualty segments of the insurance industry. During Mr. Johnson’s thirty-year tenure with Ernst & Young and its predecessor firms, he was coordinating partner of several large multinational insurance companies and for the firm’s largest American insurance client.

|

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Mr. Johnson’s work experience includes extensive coordination with the audit committees of publicly held insurance companies. His finance experience and leadership skills enable him to make valuable contributions to our Audit and Risk Committee, where he serves as the Chair. | | ●Member, American Institute of Certified Public Accountants (AICPA) |

AGE

72

DIRECTOR SINCE

2002

COMMITTEES

Compensation

(Chair)

Corporate Governance Executive

| Robert B. JohnsonRetired Senior Advisor, Porter Novelli PR

Mr. Johnson retired from Porter Novelli PR, where he was a senior advisor from 2003 until 2014. Until 2008, he served as chairman and CEO of the One America Foundation, an organization that promotes dialogue and solidarity among Americans of all races and provides education, grants and technical equipment to disadvantaged youth. Before that, he served in President Clinton’s administration as an assistant to the President and director of the President’s initiative for One America. He served two years in the Carter Administration, and then was the Business Regulations Administrator for Washington, D.C.

|

SKILLS AND RECOGNITION | | OTHER BOARD OR LEADERSHIP POSITIONS |

Mr. Johnson has extensive experience in political and media strategic planning and community involvement. He also brings to the Board substantial experience in executing public relations strategies and promoting diversity. | | ●Deputy chair, Democratic National Committee (2003 to 2004) |

12 | | AFLAC INCORPORATED2017 PROXY STATEMENT

|

Table of Contents

Proposal 1: Election of Directors

AGE

53

DIRECTOR SINCE

2015

COMMITTEES

Finance and

Investment

| Thomas J. Kenny

Former PartnerFORMER PARTNER AND CO-HEAD OF GLOBAL FIXED INCOME, GOLDMAN SACHS ASSET MANAGEMENT | | | |  INDEPENDENT AGE

56 DIRECTOR SINCE

2015 COMMITTEES

Finance and Co-Head of Global Fixed Income, Goldman Sachs Asset ManagementInvestment (Chair) Corporate Development Corporate Social Responsibility & Sustainability |

Mr. Kenny has served as a trustee of TIAA-CREF, trusteea financial services organization, since 2011. He also currently serves as the chairChair of the TIAA-CREF Funds Board of Trustees, previously served as Chair of the Investment Committee, and also currently sits on the TIAA-CREF Funds Operations Committee.Audit, Investment and Nominating and Governance Committees. Prior to his role at TIAA-CREF, Mr. Kenny held a variety of leadership positions at Goldman Sachs for twelve years, most recently serving as partner and advisory director. He also served as co-head of the Global Cash and Fixed Income Portfolio team at Goldman Sachs Asset Management, where he was responsible for overseeing the management of more than $600 billion in assets across multiple strategies with teams in London, Tokyo, and New York. Before joining Goldman Sachs, Mr. Kenny spent thirteen years at Franklin Templeton. He is a CFA charter holder. | | | |

SKILLS AND RECOGNITION | | |

Mr. Kenny’s extensive experience in investment management and financial markets provideprovides the Board with valuable insight and expertise. | | |

AGE

70

DIRECTOR SINCE

1990

COMMITTEES

Finance and

Investment (Chair)

Audit and Risk*

Corporate

Development

*Financial Expert